The latest data reveals that Cape Town has significantly contributed to the national residential property price index, marking a notable performance in the real estate sector.

What is the residential property price index?

In a concerted effort to track the property market dynamics, Statistics South Africa (Stats SA), in collaboration with the South African Reserve Bank (SARB) and with backing from the International Monetary Fund (IMF), has devised a Residential Property Price Index (RPPI).

The core objective of the RPPI is to gauge the price alterations of both new and pre-existing residential properties acquired by households.

This analysis solely considers market prices, encompassing the price of the land on which these residential structures are situated.

Stats SA revealed the foundational data for this index was procured from the transaction records registered with the Office of the Chief Registrar of Deeds (Deeds office), which holds a comprehensive administrative record of all property transactions within South Africa.

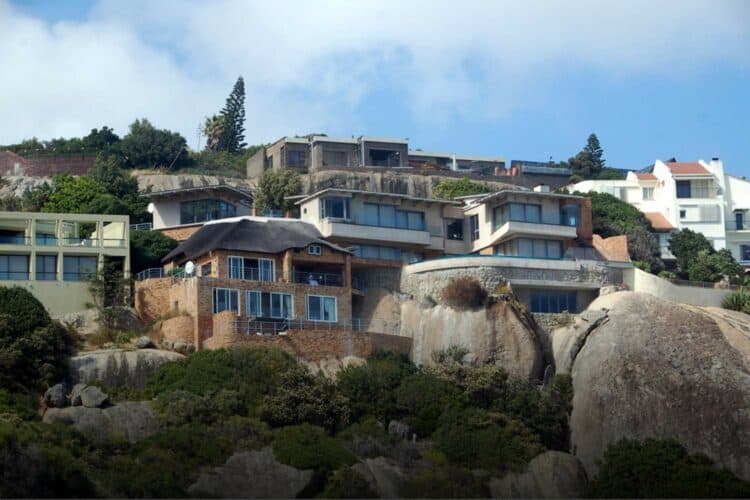

Cape Town marks 5.6% year-on-year increase in RPPI

The focus remains on free-standing houses or sectional title properties like flats, townhouses, or other houses within a gated complex.

A notable revelation from the recent data is the 3.6% surge in the annual national residential property price inflation in May 2023, ascending from 3.2% in April 2023.

This increment of 0.4% month-on-month in May 2023 has been significantly influenced by the Western Cape and Gauteng, with the Western Cape, led by the City of Cape Town, marking a 5.6% year-on-year increase, contributing 1.8 percentage points.

This data encapsulates various variables including the price, size, and type of the property, and the categorisation of the buyer and seller.

The RPPI meticulously excludes out-of-scope transactions while including those where the buyer is an individual and the seller could be an individual, company, estate, foundation, or body corporate.